India’s aviation sector is soaring—literally. With booming passenger numbers, fleet expansions, and global aircraft orders rolling in, the skies seem limitless. But beneath the clouds lies a storm of concern: 98% of India’s aviation components are still imported. This dependency is now a critical pressure point as global trade tensions tighten, especially following the United States’ recent announcement of reciprocal tariffs affecting aviation imports.

At a recent international aviation conference in Bangalore, this alarm bell rang loud and clear, and the consensus was unmistakable—India must act fast, or risk grounding its growth.

The Twin Turbulences: Skills & Imports

Two major hurdles threaten India’s upward trajectory in aviation:

- Severe Shortage of Skilled Workforce: Pilots, engineers, and technicians—India simply doesn’t have enough to match its growth rate.

- Heavy Reliance on Imports: With the US being the largest aerospace component supplier (North America holds 50% of the global market), tariffs could mean massive cost spikes. Without immediate countermeasures, both these issues could clip the wings of India’s aerospace ambitions.

The Indigenization Imperative: Mirchandani’s Masterstroke

Jaideep Mirchandani, Group Chairman of Sky One, offers a compelling roadmap: “A self-sufficient Indigenous aerospace parts market may help India through a potential global trade war.” His words are less a prediction and more a call to arms.

As Mirchandani explains, indigenization isn’t just patriotic—it’s strategic. Tariffs and supply disruptions aside, making components at home will reduce costs, create jobs, and improve turnaround times for maintenance and repair operations (MROs).

Market Forces: India’s Big Opportunity

According to Grand View Research, India’s aerospace parts manufacturing market hit $13.6 billion in 2023. By 2030, it’s projected to balloon, growing annually by 6.8%. The market’s rocket fuel? Expanding airline fleets, aircraft modernization, and a rising need for domestic MRO services.

Pro tip: India spends nearly 30% more maintaining aircraft abroad due to a lack of domestic MRO capabilities. That’s a massive cost-saving opportunity waiting to be tapped.

Made in India: Not Just a Tagline Anymore

Indian companies are already contributing key parts to the global supply chain—from landing gear to motion control systems. Several global aviation giants, including Boeing and Airbus, are actively sourcing from India. The trend? “Make in India” is becoming “Make for the World.”

Thanks to India’s:

- Robust software talent

- Competitive labor costs

- Ease of doing business reforms

- Favorable government policies

…the country is ripe for becoming an aerospace powerhouse—if it can align its potential with strategic execution.

MRO: Maintenance, Revenue, Opportunity

With increasing domestic air traffic, the demand for local Maintenance, Repair and Overhaul (MRO) services is skyrocketing. Mirchandani notes that this not only drives demand for locally made parts but also stimulates R&D, tech transfers, and high-skill job creation. The ripple effect? A self-reinforcing ecosystem that supports both domestic and global aviation players.

Building the Brain Behind the Machines

An indigenous aerospace sector cannot thrive without investing in people. From pilot academies to engineering institutes, India needs a turbocharged talent development pipeline. Collaborations between academia, private enterprise, and the government are vital to produce the skilled workforce needed to sustain this industry.

Beyond Borders: Partnering for Progress

India isn’t going at this alone. Increasing joint ventures between Indian suppliers and international aerospace firms are creating pathways for:

- Technology sharing

- Enhanced quality standards

- Faster innovation cycles

These partnerships will be critical to leapfrogging India’s capabilities from manufacturing basic components to designing and producing next-gen aviation systems.

Final Approach: What Lies Ahead

India’s ambition to lead in aerospace manufacturing isn’t just about building planes—it’s about building resilience, jobs, and technological independence. The next few years will be decisive. If India can align policy, infrastructure, and skill development, it could become the world’s next aerospace hub—not just a market, but a maker.

As global trade becomes more volatile, this pivot from import-heavy to self-reliant might be India’s best insurance policy for continued growth in the skies.

TL; DR – Quick Flight Brief

- US Tariffs Alert: New trade policies are making imported aerospace parts more expensive.

- 98% Import Dependency: India relies heavily on foreign-made aviation components.

- $13.6B Market Boom: India’s aerospace manufacturing market is set to grow 6.8% annually until 2030.

- Indigenization Key: Localizing production is not just economical—it’s strategic.

- MRO Potential: Domestic maintenance demand can fuel manufacturing and job growth.

- Skilled Workforce Needed: Urgent upskilling and training required to match industry needs.

- Global Partnerships Rising: Joint ventures with global firms are enhancing India’s capabilities.

- Mirchandani’s Vision: Sky One’s chairman calls for building a resilient, local supply chain amid global uncertainties.

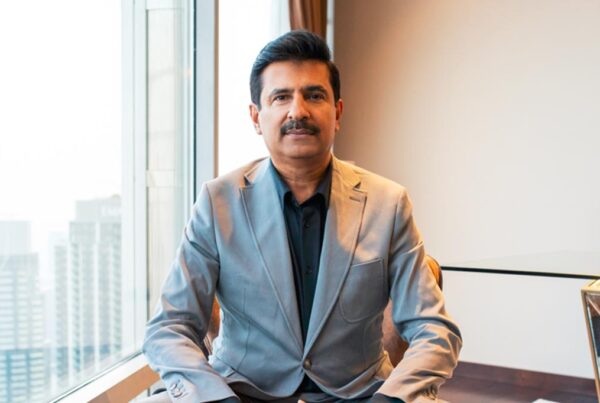

Jaideep Mirchandani

“Jaideep Mirchandani is the Group Chairman of Skyone FZE, a leading aviation holding entity with interests in several aviation firms globally managing a fleet strength of over 50 airplanes and helicopters of various modifications. Jaideep holds a Mechanical Engineering degree and brings in deep aviation management and leadership experience in operating a highly diverse and profitable aviation entity.

Source: 100 Knots